The age of self-driving vehicles (SDVs) is rapidly approaching: nearly 60% of consumers in cities around the world are open to them, according to a new survey by the World Economic Forum and The Boston Consulting Group (BCG).

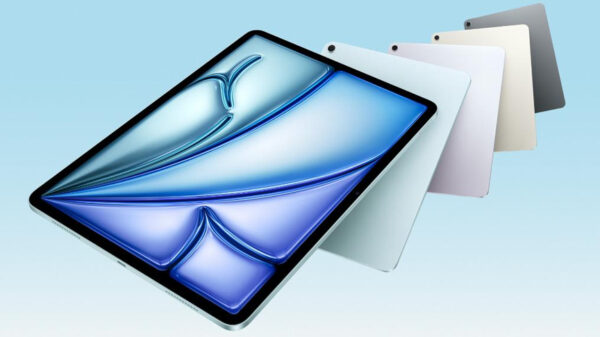

Ford offers a full portfolio of semi-autonomous technology driver assist technologies across its vehicle lineup. Vehicles including the Ford Focus, Edge and Explorer use software and sensors to steer into parallel or perpendicular parking spaces, adjust speed based on traffic flow or apply the brakes in an emergency. SCREEN GRABBED FROM FORD VIDEO.

The poll of more than 5,500 consumers in ten countries is the largest global survey dedicated to SDVs—also known as autonomous vehicles (AVs)—to date. It offers a deeper understanding of consumer sentiment about the future of automobiles and provides unique insights into the adoption of SDVs by consumers, and the support of SDVs by policy makers, in cities worldwide.

Acceptance of SDVs is highest in emerging markets, such as China, India, and the United Arab Emirates; it’s around 50% in the US and the UK; and it’s lowest in Japan and Germany. Furthermore, despite a lot of media conversation about technology companies developing the first SDVs, the survey findings show a strong preference by consumers for traditional OEMs to lead in the development and piloting of these vehicles.

“This survey is reassuring news for traditional automotive companies,” said Nikolaus Lang, a BCG senior partner based in Munich. “Our results indicate that consumers primarily expect OEMs to play a leading role in the rollout of self-driving vehicles, with technology players such as Apple or Google contributing their relevant expertise.”

Traditional OEMs Lead the Development of SDVs

The survey showed that a significant number of consumers—46%—want traditional OEMs, rather than any other type of company, to lead the development of SDVs, with respondents in France, Germany, and Japan reporting the highest levels of trust in traditional OEMs. Of that group, 69% report a preference for the vehicles to be produced through a partnership between an OEM and a technology company.

In addition, a majority of consumers expect SDVs to be electric or hybrid. The survey results bolster earlier research that identifies obstacles such as cybersecurity and regulations that all players involved in building SDVs will need to overcome together to develop win-win solutions.

Ready to Pay More for the Comfort of a Fully Self-Driving Vehicle

Nearly 60% of consumers said that they are willing to travel in a vehicle that is fully autonomous. They cite the convenience of parking assistance and an increase in productivity while traveling as the top two reasons for their desire for such cars.

Earlier research by BCG found that US consumers are willing to buy SDVs. In this survey, 53% of global consumers said that they would purchase a fully autonomous car, proving that they are as excited and eager to test SDVs as US consumers are.

Consumers are also willing to pay a premium for self-driving features and convenience: across all the countries surveyed, more than 40% of respondents said that they would be willing to pay a premium, with more than half of them willing to pay more than $5,000 for fully autonomous features.

SDVs Will Become a Reality Within Ten Years

Most policy makers in cities who were interviewed expect that SDVs will become a reality within the next ten years. A number of SDV-related initiatives and pilots are currently in the pipeline in major cities worldwide. These programs are designed to analyze how SDVs will impact consumers and cities and to examine what the future of urban mobility will look like when SDVs are included.

“These survey results provide valuable insight for understanding the necessary design of new urban-mobility models based on self-driving vehicles,” said Alex Mitchell, the head of automotive industry at the World Economic Forum. “While urban policy makers would like to see SDVs serve as a last-mile solution in less densely populated areas, consumers imagine a highly convenient end-to-end type of mobility.”

Concerns That Must Be Addressed

Though acceptance of SDVs is high, consumers still have serious concerns about safety and reliability. Of the respondents unwilling to take a ride in a fully self-driving car, 51% voiced concerns about feeling unsafe in an SDV, and 45% said that a lack of control was a major barrier for them. These concerns include both the inability to interfere with the car while it was in operation and a perceived risk of cyberattacks.

“Systematically protecting self-driving cars against cyberattacks and creating an adequate regulatory framework for autonomous driving are key requirements for this new type of mobility to develop,” said Mei-Pochtler, a BCG senior partner based in Vienna.

What’s more, only 35% of parents reported a willingness to allow their children to ride alone in an SDV, though nearly 60% of adults are willing to do so themselves. There is also hesitation regarding sharing rides in a self-driving taxi; however, this hesitation diminishes when steep discounts are offered. The highest willingness to share a self-driving taxi occurs among respondents in countries with densely populated and high-traffic areas, such as China and India.

The survey results show that although many consumers and cities are ready for SDVs, significant barriers to adoption remain. In order to overcome these barriers, a deeper, more widespread understanding of such vehicles’ functionality and benefits must be cultivated, and technology must be further developed to address safety and testing concerns.