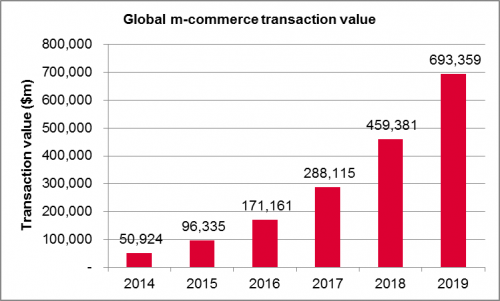

Mobile payments globally will account for US$1 trillion in value in 2017, up 124% from 2015’s estimate under $500 million, forecasts International Data Corporation.

Asia-Pacific markets will contribute to this growth greatly as mobile commerce (or mCommerce) transactions with remote payments take off across the region. Driven by a high number of initiatives and diverse mCommerce maturity level, Asia/Pacific is expected to lead the world in mobile payment (or mPayments) developments.

IDC believes that the strongest growth for mPayments will be driven in part by rising levels of mCommerce as emerging nations come online for the first time and witness an internet boom via Smartphones. Furthermore, the limited state of credit/debit card adoption in Asia/Pacific will force potential mPayments behavior to shift to using bank account inked mobile wallets.

“Smartphone adoption has grown much more rapidly than general banking and card adoption in the Asia-Pacific region,” says Shiv Putcha, Associate Research Director, and AP Connected Consumer Marketplaces at IDC Asia/Pacific. “Recent focus on financial inclusion policies in various countries have given a boost to connecting the unbanked. This phenomenon, coupled with the innovation of semi-closed wallet schemes linked to bank accounts, has given a major boost to mobile payments in Asia-Pacific.”

“When we look across the region, we see a duality between the mature Asian markets like Australia, Hong Kong and Singapore versus the emerging Asian economies like China, India and Indonesia. The mature markets exhibit strong levels of banking and card adoption and will tread a similar path as mature Western economies have for mobile payments, with a focus on proximity solutions based on Near Field Communications (NFC). These will be fertile markets for solutions like Apple Pay and Android Pay,” adds Putcha.

However, Asia’s emerging markets, which accounts for most of Asia’s population, are unlikely to follow this path. They will more likely leverage on semi-closed wallets, where consumers ‘top-up’ their mobile wallets much like they would a prepaid mobile account by linking their bank accounts.

According to Michael Yeo, Senior Analyst, IDC Retail Insights, “The markets of Asia Pacific are highly diverse and each displays significantly different characteristics as relates to their ultimate potential for mobile payments.”

IDC has been able to identify common characteristics and group these countries into three ‘clusters’ – Card Payment Leaders, Mobile Payment Leaders and Mobile Money Leaders. The mature Asian economies will remain card payment leaders and view mobile payments as an efficiency driver with proximity solutions seeking to displace the need for physical swiping of cards. The remaining Asian markets will look at mobile payments as a GDP booster and to address financial inclusion imperatives. Mobile payments in these markets will jumpstart mCommerce much like Alibaba has in China.

Going forward, IDC has identified several opportunities for sustained growth in mobile payments across Asia Pacific Excluding Japan. NFC-based proximity solutions such as Apple Pay and Android Pay will only take hold in a few mature Asian markets as their adoption is constrained by the low penetration of NFC in smartphones and readers in Emerging Asia. Mobile wallets, especially those based on semi-closed platforms, will drive much of the growth from Emerging Asian markets. Then, there will also be a significant opportunity for mobile point of sale (mPOS) device and solution vendors seeking to address gaps in card present (CP) payment scenarios in physical locations, which requires payments to be verified either by NFC or even quick response (QR) codes.