Google has unveiled the Android Pay, a mobile payments service which will let people use their smartphone to make payments in brick-and-mortar stores. But an analyst doesn’t expect take-up to surge in the near term given the continued dearth of NFC-enabled locations.

“By following Apple Pay so closely, it is probably that Android Pay will suffer the same challenges of limited initial take up by consumers,” says Gilles Ubaghs, Senior Analyst, Financial Services Technology at Ovum. “It also remains to be seen how Android Pay, will interact with the upcoming Samsung Pay.”

Android Pay, which will be incorporated into the next version of Android, currently known as Android M, represents a next stage in Google’s evolution in payments, characterized most critically by its expanding partnership network which remains U.S. market-centric.

A particular benefit will be the fact Android Pay will come preinstalled on compatible devices following its acquisition of Softcard and its deals with the major US telcos, Verizon, T-Mobile and AT&T.

Google has also announced partnerships with many of the same big merchant brands who are now on board with Apple Pay. Google reports that issuing banks are also partnering on Android Pay, to enable card enrollment, but only US Bank to date has publicly claimed support.

Google has not yet announced its revenue model for Android Pay, but it is likely to have struck a similar pricing deal with issuers for a slice of interchange rates, probably at a similar rate to Apple.

“This is a wide step away from Google Wallets initial model of focusing on collecting transaction information for use in advertising, a model which concerned many merchants who were reluctant to share this sensitive information,” noted Ubaghs.

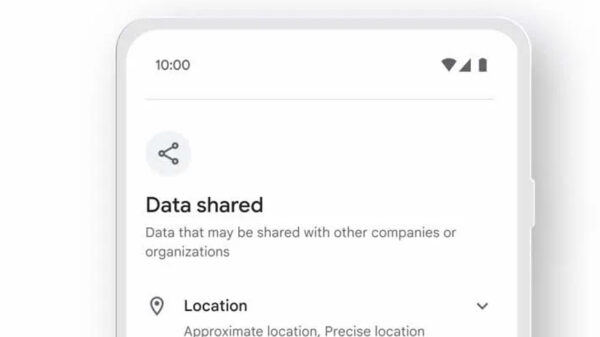

Feature wise, Android Pay is nearly identical to Apple Pay, with transactions made via NFC on proximity payment which authenticated via PIN or biometrics on capable devices, and the ability to integrate payments into mobile commerce sites and applications.

Android Pay is nearly identical to Apple Pay, with transactions made via NFC on proximity payment which authenticated via PIN or biometrics on capable devices, and the ability to integrate payments into mobile commerce sites and applications. SCREENGRABBED FROM GOOGLE WEBSITE.

For most merchants who already accept Apple Pay, Android Pay is a natural extension that will broaden the market, according to Ubaghs. One distinguishing feature of Android Pay is the integration of loyalty into a single tap at the POS, something that is expected from Apple in the near term.

“Google Claims its key differentiator is the fact Android Pay is open to developers via its API, opening up a broader ecosystem for payments. However Apple Pay also has an API open to developers and can be integrated into online and mobile payment gateways via processors such as Braintree and Authorise.Net. It remains to be seen how developers will take to this, and what may emerge,” said Ubaghs.

Ubaghs concludes that, overall, Google’s moves will help to expand the base for mobile payments in the US, but there is nothing in the announced details of Android Pay to suggest any surge in take-up in the near term.

Google has not announced any overseas implementations of Android Pay.