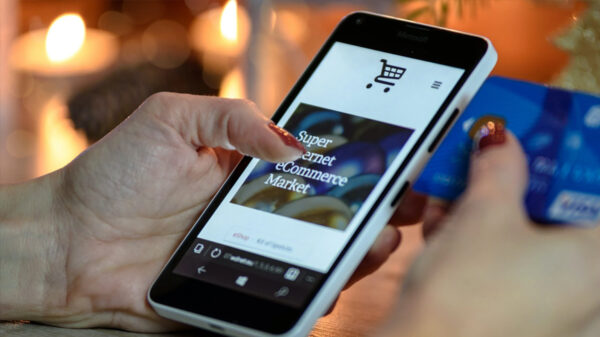

Despite the warnings shared about the possible dangers of online transactions, nearly a third of users are still careless when making online transactions, according to a survey conducted by Kaspersky Lab and B2B International.

This puts their own cash as risk, but also poses problems for banks and e-payment systems if they have to refund their clients’ losses.

To keep the dangers to a minimum, all parties involved in an online transaction should take adequate security measures.

Cybercriminals are not only interested in bank card numbers, login credentials for online banking and e-payment accounts are also firmly in their sights.

Yet 31% of respondents admitted they paid little attention to the security levels of the sites where they enter their personal or financial data.

One out five users takes no steps to protect the passwords used to access these sensitive resources. 16% confidently declared that “cybercrime in which money is taken is a rare occurrence and is unlikely to happen to me”.

Thirty percent of respondents store financial data on devices with Internet access. This would not be so risky if they always took care to use special programs for secure data storage. Unfortunately, they don’t.

For example, only 58% of Android smartphones have a security solution installed. Worse still, 31% of smartphones and 41% of Android tablets do not even have such basic protection as setting a password to unblock the advice before use.

Meanwhile many users are encountering first-hand evidence that cybercriminals are on the hunt for financial information.

Over the last 12 months, 33% of respondents reported that they had received suspicious emails claiming to be from a bank and asking for password or other information. 14% of users were redirected to web pages that asked for credentials to enter their e-payment accounts.

“When users ignore safety measures they can fall victim to fraudsters. However, the banks often end up having to pay for that negligence. With so many careless users, banks and e-payment systems operators must insure themselves against financial and reputational risks by using specialized security solutions that can prevent cybercrime,” said Ross Hogan, Global Head of the Fraud Prevention Division at Kaspersky Lab.

Kaspersky Fraud Prevention provides specialized solutions that enable banks, payment processors and e-commerce companies to prevent fraud on their online and mobile channels.

These solutions proactively protect end users and businesses alike to ensure a secure customer experience. The Kaspersky Fraud Prevention solution suite blocks account takeover and phishing attempts, as well as halting and removing malware infections.

Users are advised to install multiplatform security solutions, such as Kaspersky Internet Security – Multi-Device and Kaspersky Total Security – Multi-Device.

As well as offering general protection against cyber-threats they have a special tool that secures online payments – Safe Money (for Windows and OS X). Kaspersky Total Security – Multi-Device also includes an application that ensures secure password storage and synchronizes credentials between different devices.