In the first quarter of 2014, 26,800 3D printers were shipped worldwide, according to Canalys estimates. Of these, most were purchased by enterprise customers, ranging from micro businesses to large organizations. But 46% were acquired by consumers, up from 43% for full-year 2013, reflecting the availability of increasingly competitively priced units.

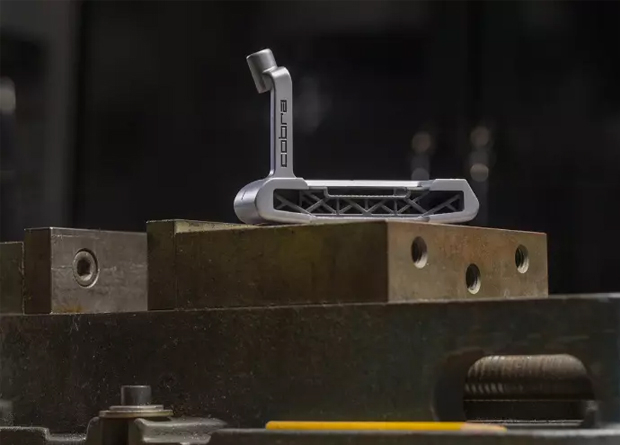

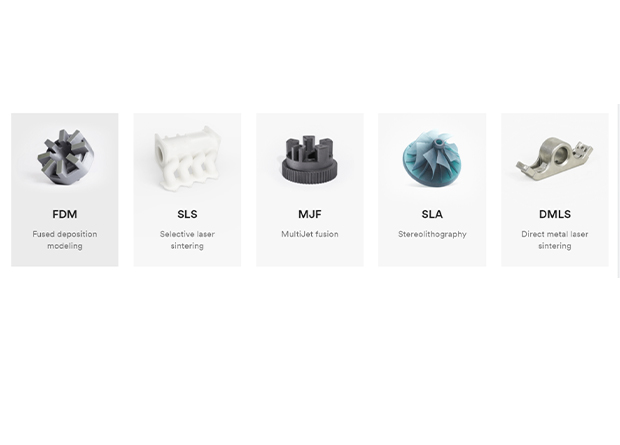

“To date, the enterprise space has been the focus of 3D printing activities. Businesses from a range of industries have invested in the technology to experiment and test its potential, to expedite design and prototyping processes, or to enable local customized manufacturing,” said Canalys Senior Analyst Tim Shepherd.

“While enterprise engagement will continue to grow, it looks to be the consumer space that will drive shipments in the near future. We are already seeing significant numbers of early technology adopters and hobbyists investing in relatively cheap 3D printers. As prices continue to fall, the technology improves and use cases are tested, this trend is set to continue.”

One notable factor in the growing availability of low-cost 3D printers is crowdfunding.

“The sheer number of ultra-low-cost printers, typically from innovative and aspiring start-up companies, which are finding investment through crowdfunding sites, such as Kickstarter and Indiegogo, is impressive. The often rapid success of these projects in reaching their funding goals shows that crowdfunding sites represent a viable source of finance in this area and, more importantly, verifies real consumer interest levels. While they are often limited in the size of objects they can print, the materials they can use and the finish they can provide, affordable printers will continue to drive interest and adoption in the fledgling consumer market, giving vendors an opportunity to upsell down the line,” said Shepherd.

Canalys estimates that 67% of 3D printers shipped in Q1 2014 were priced, pre-tax, at under US$10,000.

“In reality, there is a good number of basic printer models coming to market at sub-US$1,000 price points, and some crowdfunding projects promise sub-US$500 prices,” said Canalys Research Analyst Joe Kempton. “As competitive pressures in the market increase, various technology patents lapse, and vendors are eager to fulfill interest and demand, falling prices are making printers more affordable for more consumers.”

Kempton notes that these consumers are being addressed not just by start-up companies but also established vendors, such as Stratasys through its MakerBot-branded products.

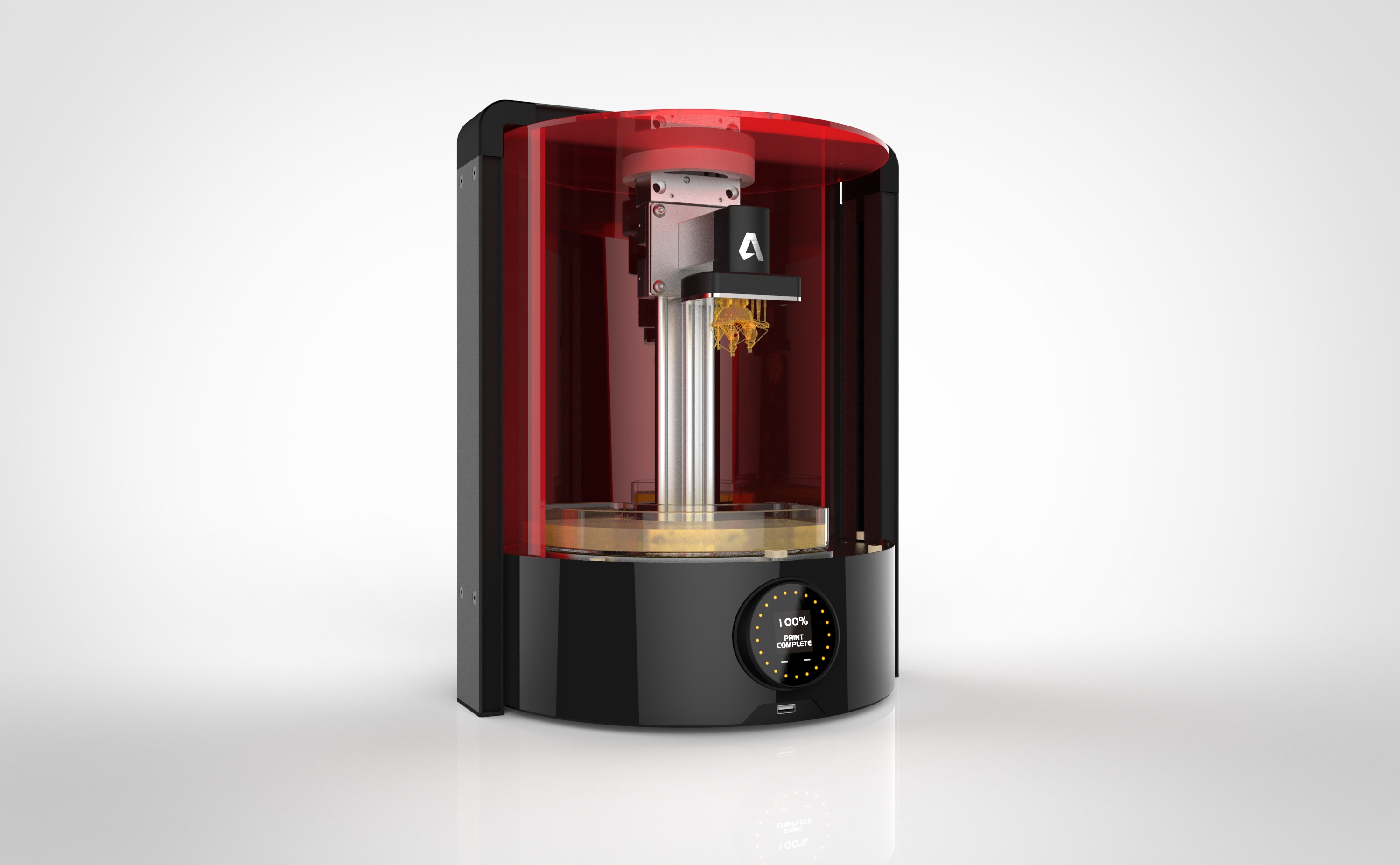

“We’ve also seen other efforts to make 3D printing more accessible, most recently from Autodesk, which is making both its 3D printer hardware and its Spark design software package open source. Within 10 years, 3D printers will be common household items in developed markets, and these developments are moving us in the right direction,” said Kempton.

Meanwhile, at the premium end of the market, industrial-grade printers costing over US$100,000 continue to make up 1% of unit shipments. Vendors targeting this space sell small numbers of printers in a year, but with price points for some high-end units at over US$1 million, it is still possible to earn substantial revenue. And increasing use of 3D printing in the manufacturing industry could yet see shipments in this area increase in coming years.