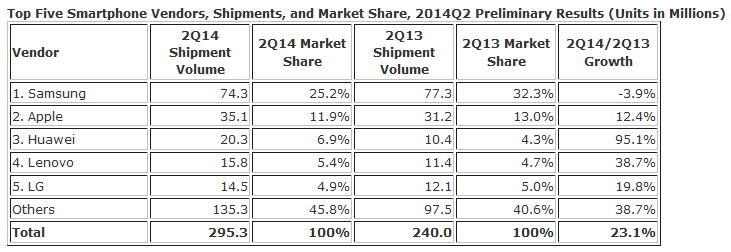

Despite a challenging quarter for Samsung, and to a lesser extent Apple, the strong market demand boosted results for most smartphone vendors. Emerging markets supported by local vendors are continuing to act as the main catalyst for smartphone growth.

Among the top vendors in the market, a wide range of Chinese OEMs more than outpaced the market in 2Q14. By far the most impressive was Huawei, nearly doubling its shipments from a year ago, followed by another strong performance from Lenovo.

“As the death of the feature phone approaches more rapidly than before, it is the Chinese vendors that are ready to usher emerging market consumers into smartphones. The offer of smartphones at a much better value than the top global players but with a stronger build quality and larger scale than local competitors gives these vendors a precarious competitive advantage,” said Melissa Chau, Senior Research Manager with IDC’s Worldwide Quarterly Mobile Phone Tracker.

The worldwide smartphone market grew 23.1% year over year in the second quarter of 2014 (2Q14), establishing a new single quarter record of 295.3 million shipments, according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

Following a very strong first quarter, the market grew 2.6% sequentially, fueled by ongoing demand for mobile computing and an abundance of low-cost smartphones. Second quarter shipments were in line with IDC’s forecast and all expectations are that the market will continue apace in the second half of the year and surpassing 300 million units for the first time ever in a single quarter in 3Q14.

“A record second quarter proves that the smartphone market has plenty of opportunity and momentum,” said Ryan Reith, Program Director with IDC’s Worldwide Quarterly Mobile Phone Tracker. “Right now we have more than a dozen vendors that are capable of landing in the top 5 next quarter. A handful of these companies are currently operating in a single country, but no one should mistake that for complacency – they all recognize the opportunity that lies outside their home turf.”

Samsung loses marketshare

Samsung saw the Galaxy S5 ship millions of units this quarter, despite the criticisms leveled at it, while S4 and even S3 volumes remained strong as more affordable alternatives. Collectively Samsung lost 7% market share compared to a year ago, despite having one of the largest smartphone portfolios of all OEMs. To maintain its position at the top, Samsung will need to focus on building momentum in markets dominated by local brands.

Apple’s second quarter is always its seasonal low of the year, but even more so this time in advance of the iPhone 6, with consumers holding their collective breath for the long-awaited bigger screens. Apple enjoyed continued success in the BRIC markets, a good sign that it is building its footprint in emerging markets. Given the pent-up demand, the third quarter could be a drought or a flood, depending on the timing of the next launch.

Huawei’s story centered on 4G LTE pick up, particularly in China, as all three national carriers subsidized 4G handsets like the P7 to encourage consumers to upgrade from 3G. Outside of China, large volumes of its lower-cost Y series fueled growth across most regions. The company continues to focus on broadening its global reach and the 2Q14 results show that the momentum is undoubtedly there.

Lenovo had a record quarter in China despite tremendous pressure from local brands. During the quarter, Lenovo saw increased success from the A788T, as well as the 3G A388T. And while its Motorola acquisition is undergoing approval, Lenovo continued to gain traction in international markets. While less than 5% of Lenovo’s shipments were registered outside of China in the second quarter of 2013, this share nearly tripled in 2Q14, with emerging markets, particularly BRIIC countries, picking up the largest volumes.

LG volumes were largely driven by its L series, helped by models like the L70, which performed well in many markets including the United States. With the G3 launched at the end of the quarter in Korea, greater volumes are expected to show up in the third quarter.