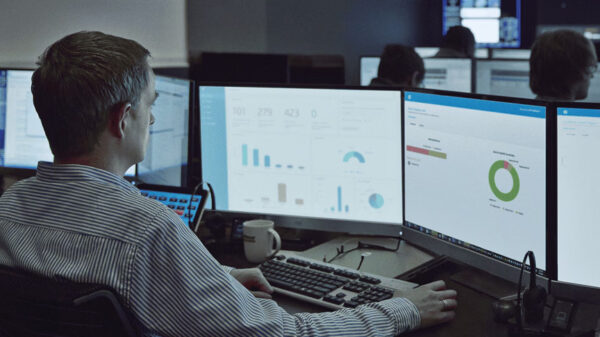

Soon you’ll be able to control and monitor your home wherever you are, if you’re not doing it already, from the cloud.

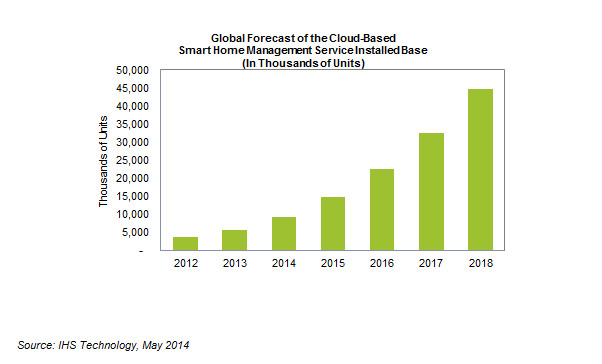

Cloud-based home management systems that allow users to remotely control household features like lighting and air conditioning are set for rapid growth in the coming years, with the installed base set to rise by a factor of eight from 2013 to 2018.

The global installed base of cloud-based home management services is projected to grow to 44.6 million at the end of 2018, up from 5.6 million at the end of 2013, according to IHS Technology. The installed base this year will surge 63 percent to 9.1 million, as presented in the attached figure.

“Imagine using your smartphone or tablet to detect an intruder in your home or to adjust the temperature in your living room—no matter where you are,” said Lisa Arrowsmith, associate director, connectivity, smart homes and smart cities, for IHS. “Cloud-based home management makes all this possible, and much more. With a wide range of companies offering such solutions, the cloud-based home management system business will expand dramatically in the coming years.”

Cloud-based home management systems and services are designed for mass-market adoption. Other applications for these systems and services include home monitoring, energy management, lighting control and independent-living services.

Master of the house

Examples of use cases for cloud home management include:

- Receiving a notification on your smartphone or tablet when your children return home from school

- Remotely adjusting the temperature of your home while at work via your smartphone, tablet or computer

- Receiving alerts if an elderly relative deviates from their normal routine

All kinds of companies head for the cloud

The types of companies offering cloud-based home-management systems vary widely.

One major group is existing service providers who have alternative core business lines, such as security or telecommunications providers and utility companies. These companies have entered the home-management market in pursuit of a means of reducing customer churn or increasing new subscriber rates and average revenue per user (ARPU).

Other types of companies also are entering the fray, including device suppliers and retailers.

Smart home specialists are expected to play a major role in the deployment of smart home services globally. This category of companies includes both home automation providers that are moving toward a cloud-based model, alongside a new breed of connected home specialists, such as Nest, Revolv, SmartThings, and others.

Big opportunity in Asia

In the Asia-Pacific region, some multiservice operators have been offering basic smart home services for a number of years, although volumes have remained relatively low. As more enter the market,with wider value propositions and attractive tiered pricing, the role of MSOs is set to grow.

However, it is device suppliers that are expected to drive the majority of growth in Asia-Pacific. In some cases, the device suppliers are expected to focus on the creation of the “smart” hardware, using open standards to make it compatible with services from other companies. However, some appliance suppliers are expected to also “own” the backend system used, creating their own branded smart home service platforms.

The American way

North America has been at the forefront of this market to date, in terms of user numbers. However, rapid growth is expected to follow worldwide.

In North America, security providers, such as ADT or Vivint, have been among the forefront of the market providing combined smart home and professionally monitored security systems. Telecommunications companies, such as Comcast or AT&T, also play a major role.

Safe European home

In the Europe-Middle East-Africa (EMEA) region, utility companies are expected to dominate, accounting for one-third of the installed base in 2018. Utility companies already offering or developing smart home devices or services in Europe include British Gas, Essent, Eneco, Nuon, RWE, EnBW, and Eon.

European multiservice operators (MSO) have generally been slower to enter the smart home service market than those in North America, although there have been exceptions such as Bouygues Telecom and Swisscom. Others, such as SFR and Orange, have also now entered the market, with further expected to follow.