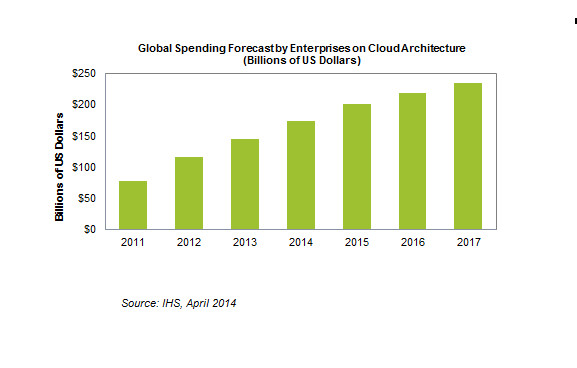

Cisco’s recent announcement that it will construct the world’s largest network of clouds with its partners will allow the company to cash in on the global trend of rising expenditures among enterprises for cloud architecture and services, according to a new report from IHS Technology.

Building on its prowess in cloud infrastructure and applications, Cisco’s move is especially timely. Enterprises will spend more than $235 billion on cloud architecture and services by 2017—a 35 percent gain from the $174 billion projected to be spent this year, and triple the $78 billion expended in 2011. This year alone, cloud spending is pegged to rise 20 percent from $145 billion last year, as shown in the attached figure.

“Enterprises today are trying to create faster, more efficient I.T. environments to ensure more responsive, agile and successful businesses,” said Jagdish Rebello, Ph.D., senior director for information technology at IHS. “In these cloud-based settings, enterprises also want to integrate the deep analytical power of big data, which will give them competitive advantages through insights about present and prospective customers.”

Enterprises are simultaneously augmenting their on-site services and capabilities with the cloud and gradually transferring those functions to online competencies. For businesses, the tasks at present center on developing initially limited sets of new apps and services that will live only in the cloud. Once they learn to create uniquely cloud-based services, apps and content, it’s likely that the new offerings will not only multiply but will also skyrocket in terms of customer acceptance, Rebello noted.

Challenges remain as outfits move to the cloud

Challenges remain as outfits move to the cloud

To be sure, enterprises will have company in their move to the cloud. Mobile network operators seeking growth will head there, too, because global mobile handset market revenue will soon peak, prompting mobile carriers to seek other money-making sources.

“Mobile operators are desperately searching for the next innovation,” Rebello said. “Software and cloud services could be the next wave of differentiation that turns the downward mobile handset revenue curve back up.”

None of these transitions to the cloud will be easy, IHS believes. Both enterprises and original equipment manufacturers of mobile devices will grapple with challenges in cloud performance, differentiation of services, new business models and the evolution of multiple cloud ecosystems.

“The players in the cloud space will have to determine their specific cloud performance requirements, as well as find their own niches and sort out or—more likely— invent their own best business models,” Rebello said.

As enterprises work on these efforts, the cloud itself will change. For one, it will enable location-independent resource pooling that will bring about new architectures and business models.

It could also raise data retention costs because cloud data storage is still relatively expensive, even though the storage industry is addressing these issues. More than 78 percent of disk storage will use cloud connections to digital content by 2017, making the need for less expensive cloud storage of paramount concern.

“Ultimately, the cloud will embrace more than just online storage; it will truly enable the market for the Internet of Things,” Rebello said, in which connections move beyond computing devices and begin to power everyday gear and objects through all facets of life. Here the cloud could reign supreme, providing the nexus where those critical connections can be made.