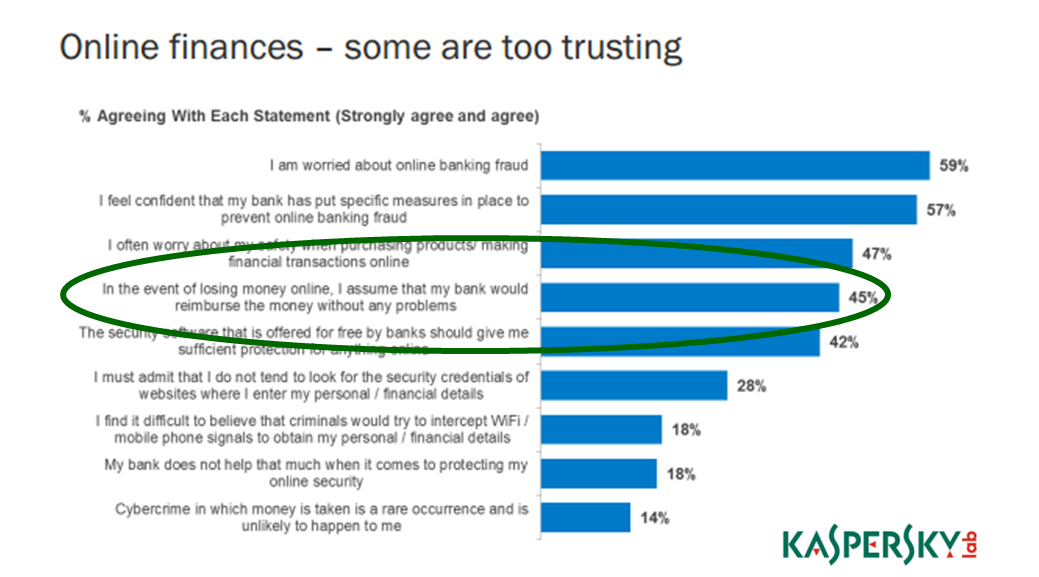

More than 45% of users who manage their finances via the Internet are sure their bank will refund them if money is stolen from their online account.

This was the finding from the Consumer Security Risks Survey 2013 conducted by the analytical company B2B International in collaboration with leading secure and threat management solutions developer Kaspersky Lab.

This confidence among customers has the potential to affect the business of financial organizations, which can suffer both monetary and reputational damages in the event of cyber theft.

Kaspersky Security Network data shows that Kaspersky Lab products protected some 1.9 million users from malware capable of stealing money online in 2013. And the number of financial cyber threats is constantly growing.

According to Kaspersky Lab statistics, every fourth phishing (i.e., fake) web page imitates the website of a legitimate bank, online store or payment service. These fake pages are used to trick people into handing over their banking details.

Meanwhile, malware authors continue to create new malicious programs capable of accessing online accounts and new ways to bypass the security tools that banks have in place.

It is little surprise that cybercriminals prefer to attack users’ computers rather than the protected IT infrastructures of banks, it is much easier to steal data from a privately-owned device.

At the same time, users often ignore the risks and neglect basic security measures when using online financial services, such as online banking.

The B2B International research found that 28% of respondents do not check the authenticity of the websites where they enter their confidential information. Also 34% of users do not take any measures whatsoever to prevent their data from being intercepted on public Wi-Fi networks.

This apathetic approach to online personal security is linked, among other things, to the belief that banks will refund customers if any money is stolen in a cyber attack. 45% of respondents believe their bank will pay back money stolen by cybercriminals, and 57% are confident their bank has already taken all the necessary security measures.

Theft from customer accounts has implications for the business of financial organizations. Apart from the financial costs, it also affects a company’s reputation and customer loyalty.

Companies use various methods to protect their clients from cyber fraud however, practice shows that full-scale protection of online transactions can only be provided by dedicated solutions developed to address the specific nature of online financial threats.

Among other things, these solutions can reduce the number of incidents that result in refunds having to be made to customers.

After assessing the demands of the market and leveraging our wealth of experience in protecting users from cyber attacks, Kaspersky Lab created the Kaspersky Fraud Prevention platform for financial and e-commerce organizations.

The solution also addresses important trends in the financial market such as the use of tablets and smartphones for conducting online payments. Kaspersky Fraud Prevention supports Windows and Mac, as well as the popular Android and iOS mobile platforms.

In addition to solutions that protect client devices, the platform also includes server components capable of identifying fraudulent activity, even if the customer hasn’t installed the security solution on his/her device.

Kaspersky Lab’s professional services are another integral part of the platform, helping companies improve their awareness of financial cyber threats and how best to combat them.

The comprehensive approach to security and the tried-and-tested technologies in Kaspersky Fraud Prevention allow banks to reliably protect their customers from cybercrime and secure their reputation.