Revved up by broad adoption among car makers, Linux is set to pass the competition and race to lead the automotive infotainment operating system (OS) market in 2020.

Global sales of the Linux OS in automotive will rise to 53.7 million units in 2020, up from less than 1 million in 2013, according to IHS Automotive, driven by Polk. The fast growth will allow Linux to overtake its chief rivals Microsoft and QNX from BlackBerry.

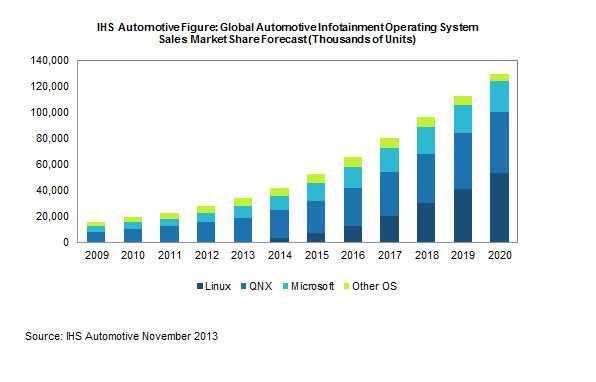

“The market for automotive infotainment operating systems represents a major opportunity for software vendors, with platform sales climbing to nearly 130 million units in 2020—about the size of the global PC market in 1999,” said Egil Juliussen, research director for IHS Automotive. “Growth is being driven by the multiplicity of platforms in many cars, with a single auto potentially having one OS for the head unit and navigation, another for the telematics system and hands-free interface for mobile phones, and yet another for the rear-seat entertainment system. Over the long term, Linux will take the lead in this burgeoning market, as auto manufacturers and their suppliers are attracted by the advantages of the OS.”

Linux comes up

The impetus behind Linux is being driven by various factors, including open-source momentum, future cost savings advantages and availability from multiple suppliers at every level in the software hierarchy.

Another reason for the success of Linux is the auto industry’s desire to control and set its own system architecture. The auto industry prefers OS platforms in which it can control direction and features. Such control is not possible in proprietary OS platforms.

The need is especially true for the Tier 1 suppliers that must control and manage the software platforms in order to retain the infotainment hardware manufacturing business. As a result, Linux is making rapid inroads into infotainment systems despite a slow start.

Automakers line up behind Linux

Numerous car manufacturers are shipping Linux-based systems in their cars.

GM is currently the volume leader, with most Cadillac models now using Linux in their CUE system. Similar Linux-based head units are also arriving or will be deployed on Buick, GMC, Chevrolet and Opel models.

For their part, BMW, PSA and Jaguar/Land Rover are committed to using a version of Linux that is compatible with the GENIVI platform.

GENIVI is an industry group founded to drive adoption of an open-source development platform for infotainment. The group’s platform consists of Linux-based core services, middleware, and open application layer interfaces.

While there are many flavors of Linux, IHS expects the GENIVI version to lead the market given the large number of automakers committed to using the platform.

Battle of the OSs

QNX is at present the market leader in the automotive infotainment OS market with 53 percent share of units in 2013. However, the OS will cede share to Linux in the coming years because of stronger competitors and uncertainty surrounding its parent firm, BlackBerry. QNX has better safety certification than other infotainment OSs, which opens additional auto opportunities that are not counted in this market forecast.

Microsoft is currently at its zenith for market share, accounting for 27 percent of shipments in 2013, with its portion then steadily decreasing to about 18 percent in 2020.

Despite the market share decline, Microsoft’s unit sales will increase through the forecast period, due to the overall rapid growth of the infotainment OS platform market.