A new survey has found that Filipino respondents showed the highest level of loyalty to mobile phone brands and mobile service providers, a sentiment shared with the rest of Southeast Asian respondents.

“Loyalty of consumers to mobile brands and mobile service providers presents clear opportunities to gain and keep the trust of customers. This signifies the importance of developing and nurturing long-term customer relationships,” states Stuart Jamieson, Managing Director of Nielsen Philippines.

Majority of Filipino consumers said that loyalty programs (marketing programs that reward members with purchase incentives) were available in retail stores where they shopped and that they were more likely to visit retailers that offered loyalty programs, according to the study by Nielsen.

The Nielsen Global Survey of Loyalty Sentiment polled more than 29,000 Internet respondents in 58 countries to evaluate consumer views on loyalty levels across 16 categories including fast-moving consumer goods, technology products and retail establishments. The Nielsen survey covered the Philippines and five other Southeast Asia markets including Indonesia, Malaysia, Singapore, Thailand and Vietnam.

In the Philippines, 61 percent of respondents said that loyalty programs were available in stores where they shopped. Loyalty programs are most prevalent in Thailand and Vietnam, where 69 percent of respondents indicated loyalty programs were available in stores where they shopped.

Vietnam and Thailand consumers were also the most likely in Southeast Asia to be enticed by loyalty programs, with 94 percent and 92 percent respectively indicating they were more likely to shop at a retailer that offers a loyalty program, followed by the Philippines, Malaysia, and Singapore (91%) and Indonesia (86%). Globally 59 percent of consumers said retailer loyalty programs were available at the stores where they shopped and 84 percent said they were more likely to shop at a retailer that offers a loyalty program.

“Similar to the rest of Southeast Asia, retail loyalty programs are growing significantly in the Philippines in recent years, both in terms of availability and popularity. These programs are influencing consumers’ choice of store, with Filipino consumers saying that they more likely to be enticed by loyalty program offerings,” says Jamieson. “Through these loyalty programs retailers can customize their offers to individual customer needs, thereby increasing the frequency of visits to their stores as well as the amount spent.”

Loyalty program benefits

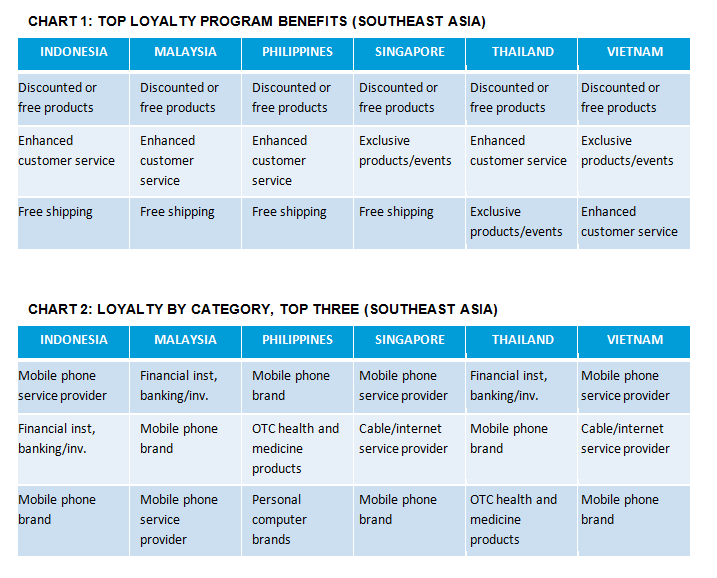

The offer of discounted or free products was viewed by 85 percent of Filipino respondents as the most valuable loyalty program benefit, consistent with other Southeast Asia markets surveyed. More than half of Filipino respondents ranked enhanced customer service as the second most valuable program benefit while Singapore and Vietnam respondents viewed exclusive deals as the second valuable benefit.(See Chart 1).

Of the 16 categories covered in Nielsen’s survey, Filipino respondents showed the highest level of loyalty to mobile phone brands and mobile service providers, a sentiment shared with the rest of Southeast Asian respondents. Health and medical products, and personal computer products also secured high levels of loyalty from Filipino respondents. Conversely, alcoholic beverages were ranked by respondents in the region as the category to which they attributed the lowest level of loyalty, along with online retailers. (See Chart 2).

Incentives to switch brands, services and retailers

According to Nielsen’s survey, quality is the attribute offered by brands, service providers and retailers which would encourage Filipino consumers to switch. This is the highest is the region with 51 per cent. Singaporean and Vietnamese consumers showed the highest price sensitivity, with 52 percent of consumers in both markets indicating they would switch to an alternative brand/service/ retailer if it offered a better price. (See Chart 3).

“Filipino consumers placed the highest premium on quality while the rest of the consumers in Southeast Asia also gave importance to quality—higher than the global average,” says Jamieson. “This emphasizes the shifting focus of consumers as incomes increase and their purchase drivers move away from price alone.”