By Paul Skipski, Chief Financial Officer, IBM Philippines

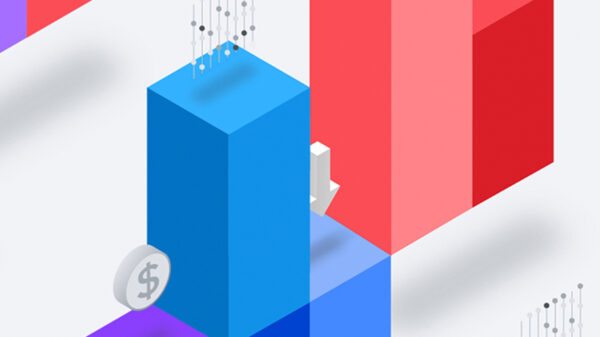

As a Chief Financial Officer, do you fully understand risk exposures across your organization? Can you trust your governance processes to sufficiently ensure accurate risk reporting? Are you able to accurately quantify the risk factors of a transaction?

Risk influences all that we do – from the smallest business decisions to the largest ones. The lack of risk-awareness culture especially in financial institutions can be devastating. CFOs can draw upon insights gleaned from Big Data to predict where things may go wrong and devise proactive strategies to get back on course.

There are no global standards or common law to regulate consistent business practices and business dealings internationally. Currently, different countries and regulators are issuing directives and regulations to enforce and contain bad behavior that may exist in the corporate world. Most countries around the world have their own standards but the nuances and enforcement of such practices and laws are very different. In ASEAN, such differences exist in the law itself and its application. To make things worse, regulators have lost patience with increased cases of non-compliance.

However, with use of the right tools, risks can carefully be calculated, controlled and managed, greatly reducing the variable of bad luck. Many successful CFOs today are accounting for the impact of outside forces – from the ever changing regulatory and compliance landscape, interest rates, supply chain and other operational events to natural disasters and even consumer sentiment – to inform, shape and govern their corporate strategies.

Regulatory compliance and beyond

While the nature of the finance function has historically been to analyze past performance, risk is inherently forward-looking. CFOs must move beyond their traditional domain and use performance indicators and risk to predict the future. By discovering hidden patterns of risk rooted within their ledgers and spreadsheets – and integrating risk with financial management – CFOs can provide critical linkages between strategy and execution and stay ahead of the curve.

Since every risk comes home to roost in a financial number between the lines of the balance sheet, CFOs are playing a much larger role in risk management. They increasingly are influencing, setting and driving corporate risk strategies, working closely with the chief risk officer and chief operating officer.

Armed with financial and operational data that can inform decisions, CFOs are in position today to help their organizations avert roadblocks and wrong turns, as well guide the business down new paths of profitability.

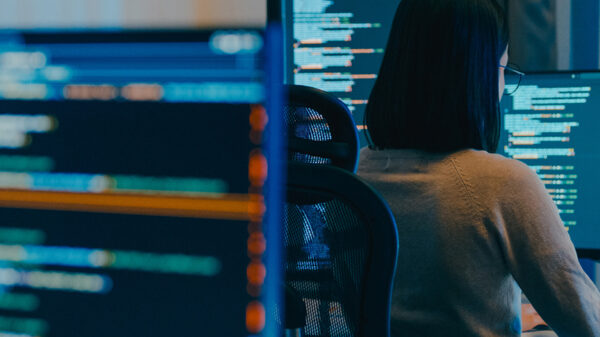

Moving forward with Big Data and predictive analytics

Forward-looking CFOs are using insights gleaned from Big Data and predictive-analytics technologies to accelerate business performance. By embracing a data-driven approach, CFOs can influence major, strategic corporate decisions involving acquisitions, divestitures, demand planning and forecasting, new markets and more.

Today’s predictive risk models can be enormously helpful to anticipate and control levers of uncertainty by using “what-if” scenarios to determine specific outcomes. CFOs can draw upon Big Data insights to predict where things may go wrong, and then devise a proactive strategy to get back on course.

For example, if a CFO notices that customer retention is on the decline by analyzing social media chatter, he/she can make a new directive for the business to implement new loyalty programs. By using customer data as a leading performance indicator, the CFO can spearhead smarter growth strategies.

Holistic Approach

Of course, technology alone is not the answer. The successful adoption of an enterprise risk management platform requires a truly pervasive approach to risk management.

Here are some areas for consideration:

• There should be a distinct and consistent tone from the top including senior management and the board, which sets the policies and guidance around both risk taking and avoidance.

• A company should have a sound commitment to ethical principles, which starts with the value system of individual employees.

• Transparency around both sharing across the organization and encouragement to employees to report risks.

The successful adoption of any enterprise risk management requires trust; trust in your systems, processes, and people. Trust in the quality and reliability of the underlying data and operational processes, trust in the integrity of the analytics, and trust in the management processes driving reliable actions emanating from risk insights. Without trust, management may pay lip service to risk analytics.

As the CFO’s role is on the verge of change, finance professionals have an opportunity to become more than just the corporate scorekeepers. Bearing in mind the importance of trust, combining clear policies with the beauty of Big Data and analytics will reveal the opportunity cost of not taking a risk. By using Big Data to manage risk, the CFO can emerge as a powerful and strategic decision maker.